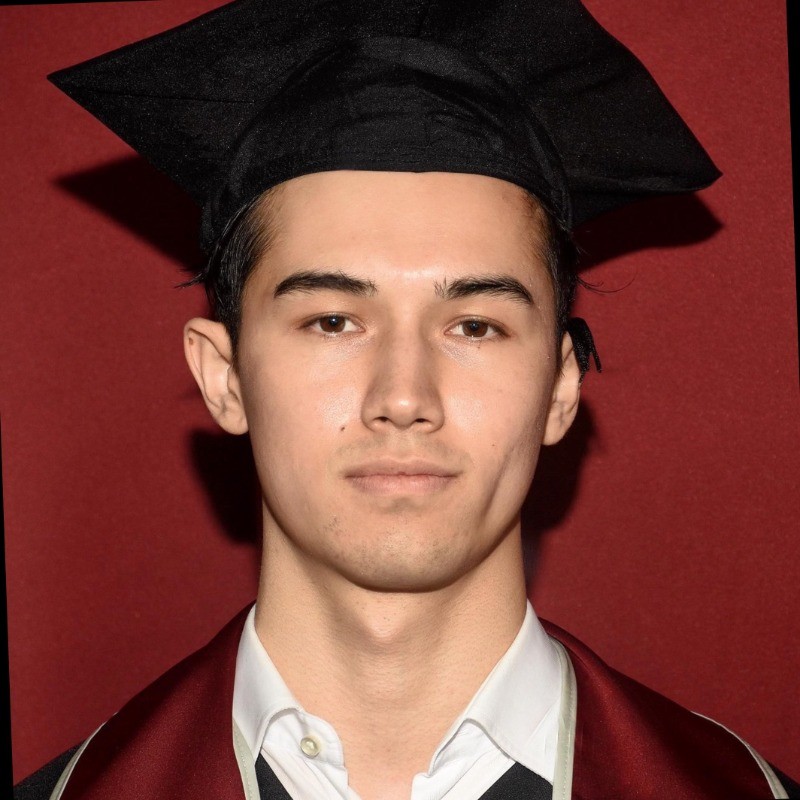

About Me

Hi! I’m currently an Equity Options Trader at Susquehanna in Bala Cynwyd, PA. I’m also pursuing an M.S.E in AI from UPenn and I graduated from UChicago in June ‘24 with a B.S. in Computational and Applied Mathematics (Honors), a B.A in Statistics, and an M.S. in Computer Science. My Honors Thesis, “Mathematics of Leveraged ETFs, Beta Decay, and Long-Term Investment Viability”, was advised by Professor Dylan Hall. My interests include film, meditation, personal fitness, and reading non-fiction.

Experience

Susquehanna International Group, LLP (SIG), Quantitative Trading Intern

• Studied options/poker theory, event forecasting, and competed in outcry mock trading; placed 1st in intern gaming competition

• Leveraged Python, Scikit-Learn, and Bloomberg for use in data analysis project (details omitted due to IP restrictions)

Chicago Trading Company (CTC), Machine Learning Researcher

• Met weekly with Head of AI/ML at CTC to construct pipeline analyzing Tweet sentiment and engagement for stock price prediction

• Trained FinTwHIN-BERT NLP model to derive sentiment classification achieving accuracy of .89, published model to Hugging Face

• Developed script to scrape tweets from X into AWS; constructed EMA-weighted sentiment index referencing academic literature

• Tuned Random Forest and Naïve Bayes models for hourly stock price classification, achieved highest accuracy of .59 on $PYPL

PEAK6, Trading Intern

• Studied options theory/discretionary volatility market taking, shadowed traders, and rotated on Volatility Arb, LEAPS, High-Touch desks

• Presented to CEO on quantitative portfolio allocation including long \$SLV vol (backtested mean-reversion on IV term structure), short \$PARA vol (modeled IV/RV spread and skew lookback), and short \$DOCU vol (SaaS take-private fundamental projection)

Sol Systems, Trading Intern

• Utilized Python/HeidiSQL to backtest strangle/spread options strategies on Cali Carbon Allowance futures over 20+ expirations

• Trained on energy market structure and optimized strategy capital allocation in Excel by researching annual IV and correlation risks

• Pitched strangle strategy to CEO, approved for $200k allocation, assisted lead trader with strike selection/execution; P&L at +45%

J.P. Morgan, Quantitative Research Intern

• Developed ‘GSE Arbitrage’ algorithm and UI in Python to analyze pricing differential between Agency versus Non-Agency Mortgage-Backed Securities structuring

• Created tool to identify structuring arbitrage opportunities in the Non-Qualified Mortgage space by parsing/analyzing CDI data; presented results to MD

• Implemented daily risk reports emailed to New Issue Jumbo traders by codifying DV01 rate scenarios in Athena Studio; pushed code into production

Extracurriculars

Maroon Capital, Co-President and Head of Career Recruiting

• Presented curriculum to oldest/largest quant club (220+ annual applicants), helped 65 analysts w/recruiting, and added 7 sponsors

• Managed analyst team to design, backtest, and optimize options “wheel” mean-reversion trading strategy utilizing MACD indicators

• Conducted research/t-tests on ESG risk premium, created L/S portfolio allocations, and regressed returns on Fama-French models

Financial Markets Program, UChicago Trading Competition Team (Case Writer)

• Wrote ETF market making bots, informed mock hedge funds, difficulty parameters across price paths, and a live orderbook in Rust

• Simulated 20 years of correlated prices using GBM/skew to test 200+ competitor’s portfolio optimization abilities at the 2024 UChicago Trading Competition

• Led team of 4 to implement Markowitz mean-variance portfolio optimization for return prediction beating 40+ schools at 2022 UChicago Trading Competition

Relevant Courses

• CMSC: C Programming, Data Engineering, Databases, DS&A, Discrete Math, Typed Racket

• DATA: Applied Data Analysis, Ethics, Fairness, Responsibility, and Privacy in Data Science

• FINM: Algo Trading, Big Data, Options Pricing, Quantitative Portfolio Management

• MATH: Analysis in Rⁿ, ODEs, Numerical Analysis, Numerical Linear Algebra, Probability

• MPCS: Applied Fintech, Intermediate Python, ML, Parallel Programming, Unix Systems

• STAT: Categorical Data, Linear Models, Optimization, Regressions, Statistical Theory

Awards

• Citadel Midwest Datathon (1st Place - \$10,000 Prize)

• Citadel Securities Trading Challenge (2nd Place)

• Optiver TraderHack Algorithmic Trading Competition (Finalist)

• PEAK6 Poker Tournament (1st Place)

• UChicago Trading Competition - Portfolio Optimization Case (2nd Place)

Skills & Interests

• Technical Training: AWS, Bloomberg, Excel, Git, Python (Keras, Matplotlib, NumPy, Pandas, PyTorch, Scikit-Learn, SciPy, TensorFlow), R, SQL

• Certifications: Akuna Capital Options 101/201, Machine Learning & Deep Learning (Coursera), SIE/Series 57, Two Sigma New Seekers Summit

• Programs: Berkeley Trading Competition, Bluebonnet Data Science Fellowship, D.E. Shaw Nexus Fellowship, Discover Citadel

• Interests/Clubs: A24, fitness, Iron Key Society (Scholarship Chair), rugby, UChicago Democrats (Outreach Director), UChicago Effective Altruism